Tokenized Real-World Assets

Related Organizations

A decentralized asset financing protocol that connects real-world assets (including real estate debt) to DeFi liquidity.

United States · Company

A decentralized asset financing protocol that connects real-world assets (including real estate debt) to DeFi liquidity.

United States · Company

Digital asset securities firm.

DeFi credit protocol that allows for crypto borrowing without crypto collateral, targeting emerging markets.

Multinational investment bank and financial services holding company.

Builds infrastructure to bridge carbon credits onto blockchains, creating tokenized carbon reference tokens (BCT, NCT).

WisdomTree

United States · Company

ETF and ETP sponsor and asset manager.

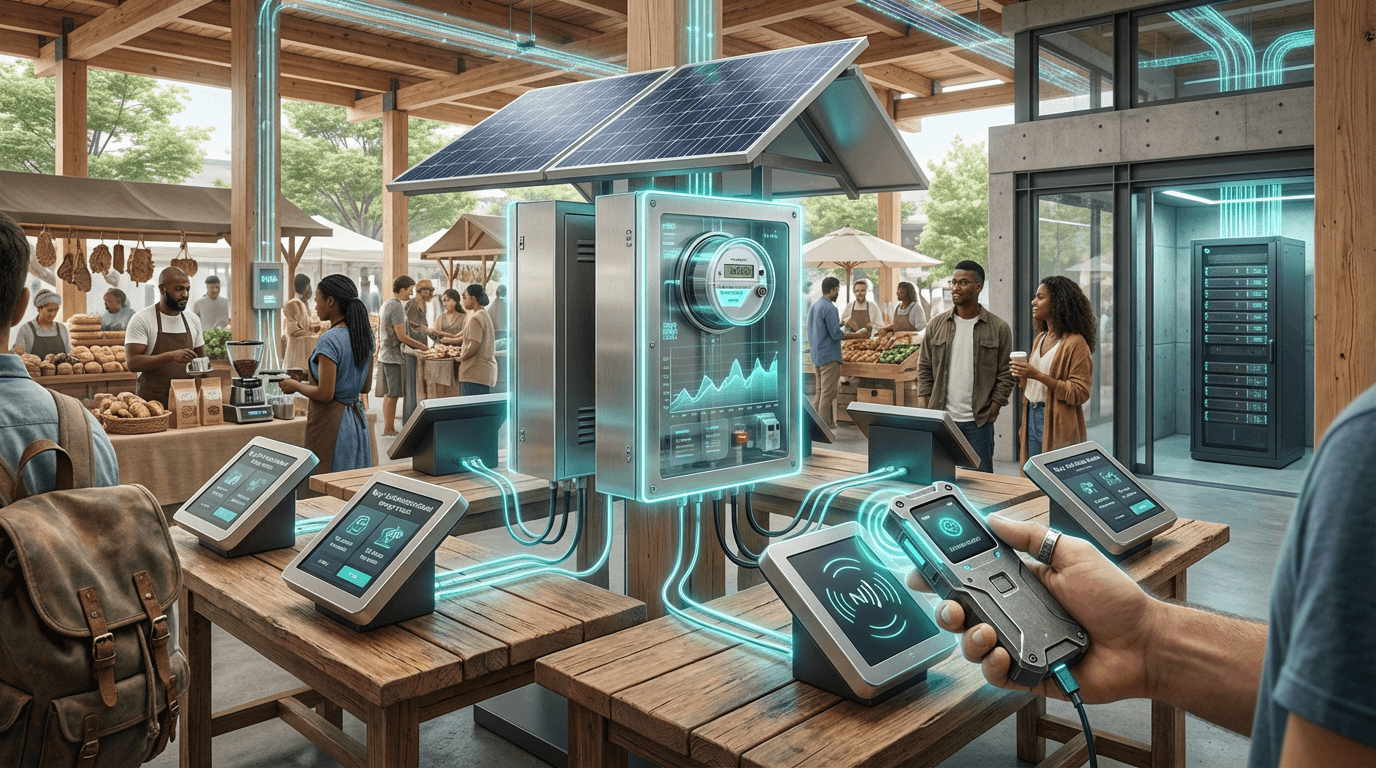

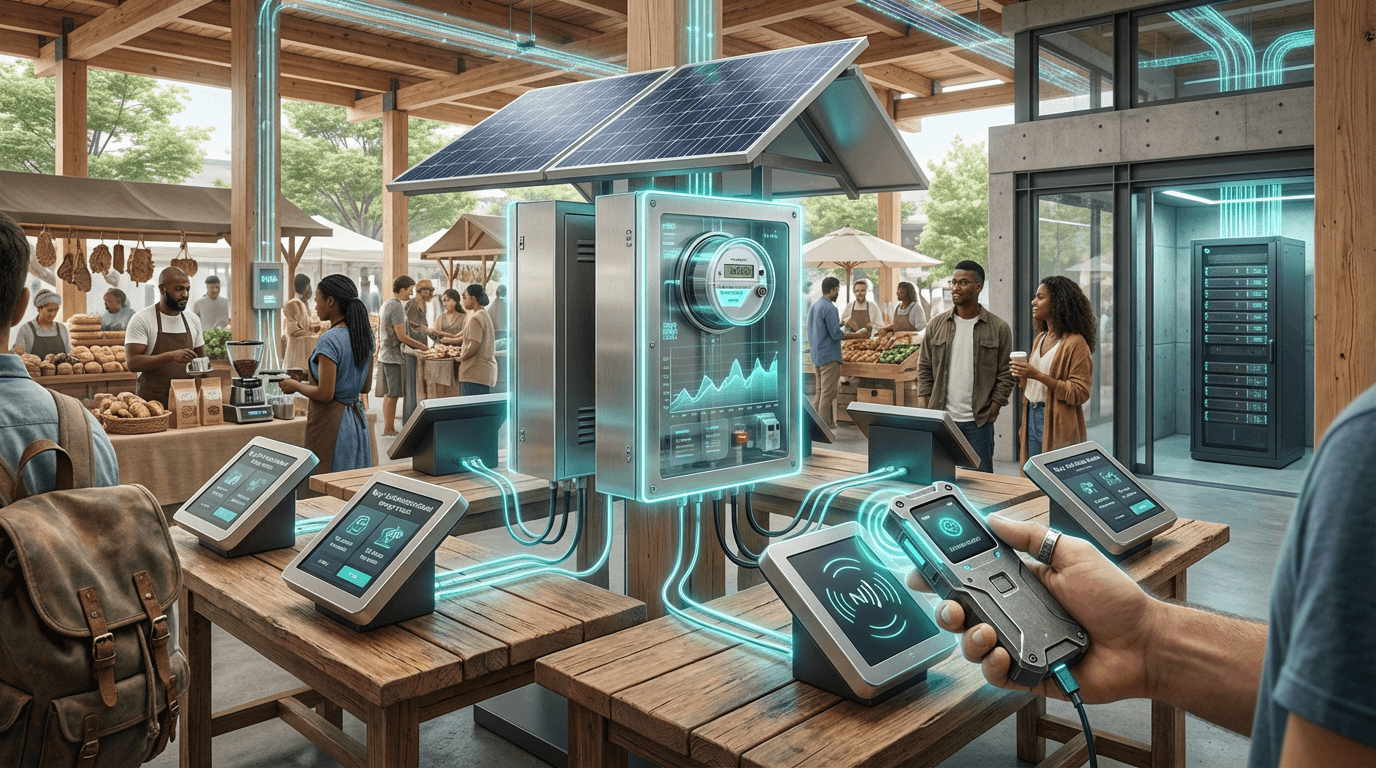

Tokenized real-world assets (RWAs) are blockchain-based representations of physical assets that create liquid, tradeable markets for infrastructure, energy credits, carbon rights, commodities, and fractionalized physical assets (where ownership is split into many shares), enabling assets that were previously illiquid or difficult to trade to be bought and sold easily on blockchain platforms. Early deployments include tokenized treasuries (government bonds on blockchain), private credit (loans represented as tokens), real estate funds (property ownership as tokens), and invoice factoring (accounts receivable as tokens), while more ambitious designs target geo-bound token systems that anchor local communities, energy grids, or city-scale services to a digital value layer, creating new models for asset ownership and trading.

This innovation addresses the illiquidity and inefficiency of traditional asset markets, where many valuable assets are difficult to trade or fractionalize. By tokenizing assets, these systems can create more liquid markets. Companies, financial institutions, and blockchain projects are developing these capabilities.

The technology is particularly significant for enabling new forms of asset ownership and trading, where tokenization could unlock significant value. As these systems expand, they could transform asset markets. However, ensuring legal compliance, managing custody, and maintaining asset backing remain challenges. The technology represents an important evolution in asset markets, but requires continued development to address legal and technical challenges. Success could unlock significant value in illiquid assets, but the technology must overcome regulatory and technical hurdles. Tokenized RWAs are a rapidly growing area of blockchain finance.