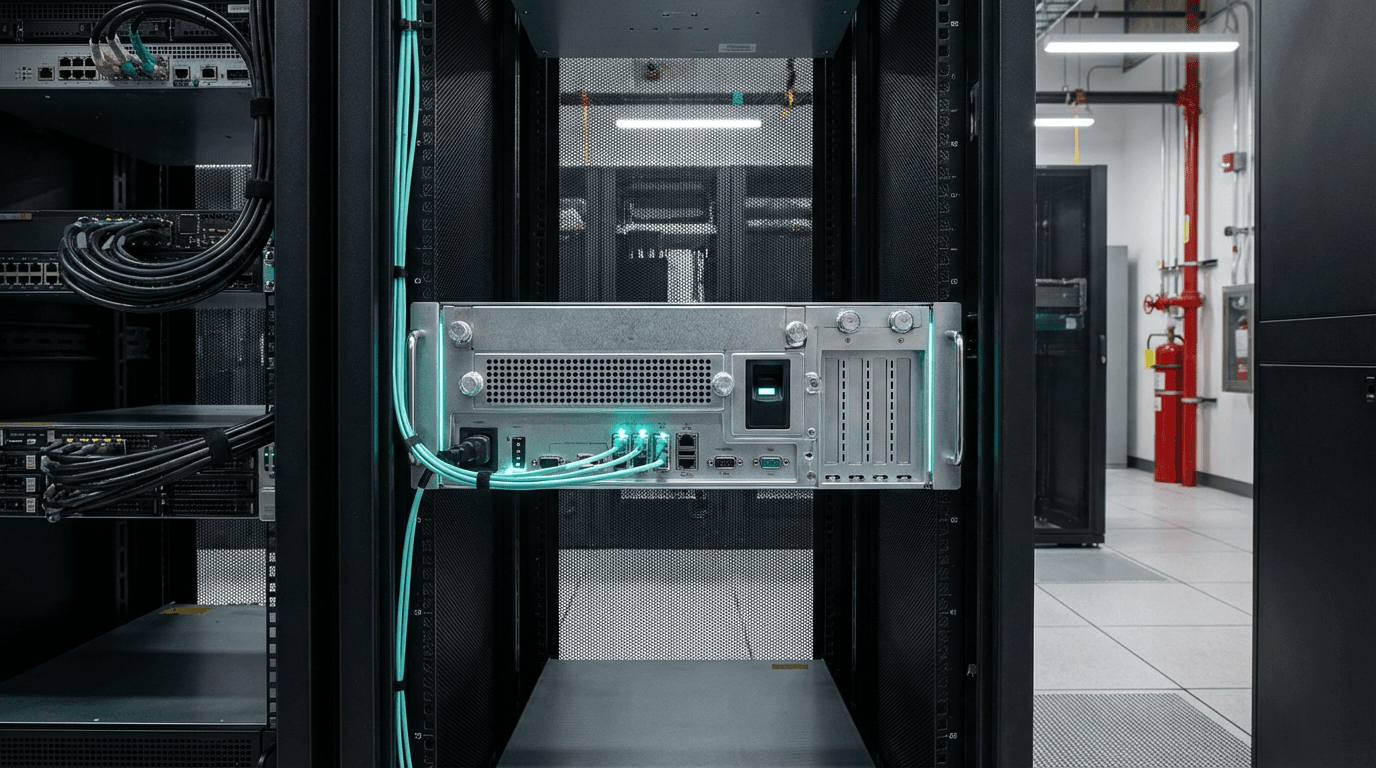

Custody-grade hardware security modules (HSMs) are hardened, specialized security appliances designed for institutional cryptocurrency custody, providing secure key management for multi-signature schemes (where multiple parties must approve transactions) and multi-party computation (MPC) wallets (where keys are split across multiple parties). These systems underpin exchange custody services, cryptocurrency exchange-traded fund (ETF) products, and bank-grade settlement flows, enforcing strict access control, key sharding (splitting keys across multiple secure locations), and comprehensive auditability for large pools of digital assets, ensuring that institutional investors and financial institutions can securely store and manage cryptocurrency holdings with the same level of security and compliance expected in traditional finance.

This innovation addresses the need for secure, compliant cryptocurrency custody for institutional investors, where traditional software wallets don't meet the security and regulatory requirements of large financial institutions. By providing hardware-based security with institutional-grade features, these HSMs enable institutional adoption of cryptocurrencies. Companies like Thales, Utimaco, and specialized crypto custody providers are developing these systems.

The technology is essential for enabling institutional adoption of cryptocurrencies, where secure custody is a prerequisite. As institutional investment in crypto grows, custody-grade security becomes increasingly important. However, ensuring security, managing complexity, and achieving regulatory compliance remain challenges. The technology represents an important infrastructure for institutional crypto adoption, but requires continued development to meet evolving security and regulatory requirements. Success could enable broader institutional adoption of cryptocurrencies, but the technology must continue to evolve to meet the security and compliance needs of large financial institutions.